Here are Visual Capitalist’s Marcus Lu’s and Iman Ghosh’s observations about the U.S. government’s current national debt situation:

The National Debt Today

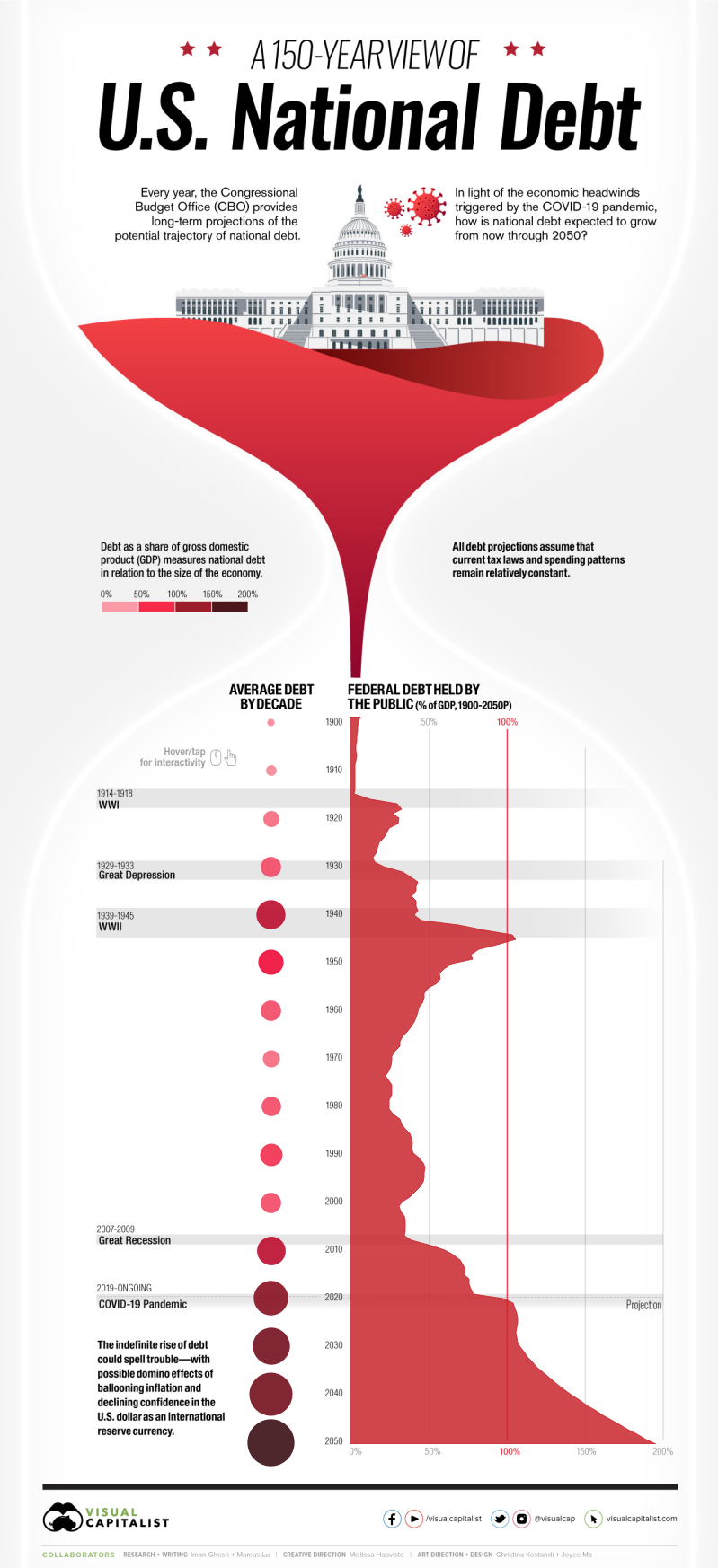

The COVID-19 pandemic damaged many areas of the global economy, forcing governments to drastically increase their spending. At the same time, many central banks once again reduced interest rates to zero.

This has resulted in a growing snowball of government debt that shows little signs of shrinking, even though the worst of the pandemic is already behind us.

In the U.S., federal debt has reached or surpassed WWII levels. When excluding intragovernmental holdings, it now sits at 104% of GDP—and including those holdings, it sits at 128% of GDP. But while the debt is expected to grow even further, the cost of servicing this debt has actually decreased in recent years.

This is because existing government bonds, which were originally issued at higher rates, are now maturing and being refinanced to take advantage of today’s lower borrowing costs.

The key takeaway from this is that the U.S. national debt will remain manageable for the foreseeable future. Longer term, however, interest expenses are expected to grow significantly—especially if interest rates begin to rise again.

The Risk of Exploding Interest

Lu is absolutely correct regarding the risk of higher interest rates. The accumulation of so much debt at today’s near-zero interest rates threatens to become a time bomb. That’s because the Biden-Harris administration has no plan to reduce it.

Consequently, that large new debt will be rolled over, with new borrowing to pay off Uncle Sam’s old debt bills. Even a small increase in interest rates will explode the amount of interest the U.S. government must pay its creditors.

There are three ways to prevent that outcome:

- Hold interest rates near the zero percent level indefinitely.

- Impose new and higher taxes to balance the budget.

- Reduce government spending to balance the budget.

Holding interest rates near zero percent comes with the cost of much higher inflation. That’s something we’re already seeing today. A Bank of America analyst predicts U.S. inflation will remain elevated for at least the next two to four years.

New and higher taxes come with a large economic cost, harming the U.S. economy’s ability to grow large enough fast enough to make higher interest payments on the debt affordable.

Reducing government spending would be the least painful way to minimize the amount of debt that must be rolled over. As you might imagine, this option is the least popular among politicians and the special interests who fund their election campaigns.

None of this is a surprise to today’s policymakers. They themselves acknowledge the U.S. government’s fiscal policy is on an unsustainable path.

Until they correct course, Americans can expect to swim in an ocean of red ink as far as the eye can see.

The Beacon – Independent Institute

Craig Eyermann • Thursday July 1, 2021 3:58 PM PDT